EASY

The gateway to guided wealth building.

Saving solution for simplicity-seekers, offering professionally predefined strategies for every risk appetite.

REGISTER FOR FREE NOW

Designed to offer noteworthy saving interests and return-packed opportunities.

Affordability at the core

Competitive prices & fee-free saving.

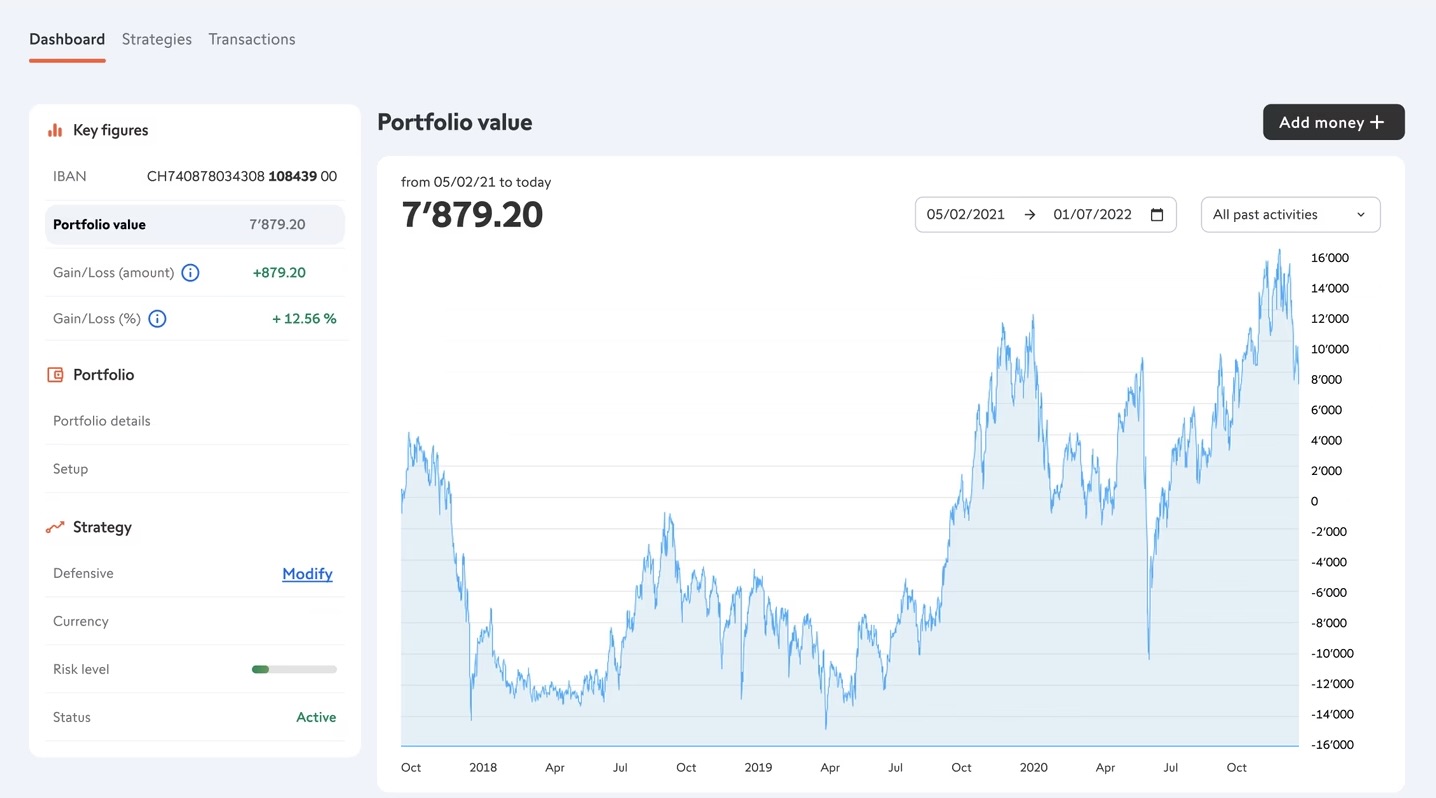

Professionally predefined strategies

Ready-made strategies designed to boost your savings.

Let our solution do the talking for us

Check out how it works before committing: bid farewell to navigating the overwhelming choice out there and fearing a bad or saving decision, and welcome the simplest and affordable way of making the most out of your capital.

Is it reliable?

Given the prevalence of unethical practices, it is natural to be cautious. However, everything is backed by extensive research conducted by leading economists, mathematicians, and developers. The software utilizes advanced trading strategies and risk management plans designed to help you.

Free of off-putting prices

Put your capital to work for you, affordably: competitive fees, saving with attractive interests.

| 0 – 50'000 | 1% | 1.5% | 1.75% | 2% |

|---|---|---|---|---|

| 50'001-100'000 | 0.50% | 0.75% | 1% | 1.25% |

| Over 100'000 | 0.25% | 0.30% | 0.50% | 0.75% |

| *New rates starting on 1.07.2024 | ||||

| Cash-out limit | 25’000/month* |

| Notice period to exceed cash-out limit without penalty | 3 months |

| % penalty over 25'000 cash-out | 1% |

| Strategy fee | No fees |

| *Not applicable to transfers to another Easy strategy or currency conversions within Saving Strategy, which are free of restrictions and limit. Prudent Strategy, Balanced Strategy, Ambitious Strategy |

|

| Prudent strategy | Balanced strategy | Ambitious strategy | |

|---|---|---|---|

| Product fees* | 0.21% | 0.19% | 0.14% |

| Strategy fee | Yearly management fees of 0.60% | ||

Saving Strategy

What are the main advantages of the Strategy?

Attractive interest rates of up to 2% Multi-currency strategy Easy transfer of funds between strategies and currencies with no withdrawal restrictions or conditions

What are the costs of the Saving Strategy?

Saving Strategy is fee-free.

How do the degressive interest rates work?

The interest rates are applied per amount range. This means that if a client makes a cash deposit of, for example,150’000 into their Saving Strategy, the interest rates would apply as follows:

1% on the first tranche of 50’000

0.50% on the tranche from 50’000.01 up to 100’000

0.10% on the remaining 50’000

Please notice that these ranges and interest rates are subject to change over time. You will be notified accordingly.

Strategy Tester

This feature allows users to test and verify the software’s performance across various assets. Different testing modes are available, helping clients optimize the software's performance by experimenting with various trade parameters as permitted by the system.

Strategies

1What are the costs of the strategies?

The strategies cost a flat fee of 0.60%. To this, external product fees are added, based on the strategy chosen:

Prudent Strategy: 0.21%

Balanced strategy: 0.19%

Ambitious Strategy: 0.14%

The product fees are subject to change over time, depending on the underlying costs and the weight of each underlying.

The following fees are already included in the offer:

Transaction fees

Deposit fees

Incoming fund transfers (from bank or post office accounts)

Annual report/Tax return/Income statement

Furthermore, no stamp duties are applicable.

The following costs are not included in the offer:

Stock exchange fees..

2How long does it take for a new strategy or a switch of strategies to be effective?

A strategy is active and a switch effective as soon as it is selected, and up to the moment where you decide to stop it via the Setup option.